The 2 Simple & Straightforward Methods for Market Sizing Your Business

- August 27, 2023

- Knowledge Base

- 0 Comments

When you’re considering a new venture, one of the first things you should do is determine whether there is a valuable market for it.

Imagine putting in months of hard work to realize that there are only 100 people in the U.S. who will potentially buy your product. Knowing this early on will enable you to make educated business decisions and decide what’s worth pursuing.![→ Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Discover the methods to calculate your market size and accurately measure your business’ revenue potential.

Keep reading, or jump to the section you’re looking for:

What is market sizing?

Market sizing is the process of finding how big your product’s audience or revenue could be. So, market size is the total number of potential buyers for a product or service and the potential revenue reach based on that population size.

When market sizing, you’re calculating customer numbers to measure the growth potential of your business.

Why is market size important?

There are several reasons why every business should spend time sizing its market:

- Market sizing helps you figure out if your product is a worthy investment. Say you have a great idea for a product but there are only 100 people who would buy it. From there, you can decide if that population size is worth the cost of manufacturing, production, distribution, and more for your product.

- Market sizing helps you estimate profit and potential for growth. If you know how many people your business has the potential to reach, you can estimate how much revenue you can generate. This is valuable for both business owners as well as investors.

- Market size defines who you’re marketing to and what their needs are. No business can succeed without marketing. Knowing your market size is the first step in understanding your target market and their needs.

- Market sizing helps your business make better decisions. Understanding your market landscape, gaps, and opportunities will inform your decision-making. It can also help you set more realistic goals, assign resources, and refine your strategies.

- Market sizing helps your business minimize risk. Starting or expanding a business is inherently risky. Understanding your market can help you anticipate and prepare for challenges.

Market Size vs. Market Value

Market size is the total potential demand for a product or service. This number usually calculates the number of potential customers, units sold, or revenue generated. So, market size is an estimate of the overall market reach.

Market value refers to the financial worth or estimated market capitalization of a company or industry. It’s a measure of perceived value. It can give you an idea of how much a company could sell for in a given market.

In summary, market size focuses on the potential market opportunity, while market value is the financial value of an individual company or an entire market.

Market Sizing Terms to Know

Before diving into how to figure out your market size, there are a few helpful terms you should get to know.

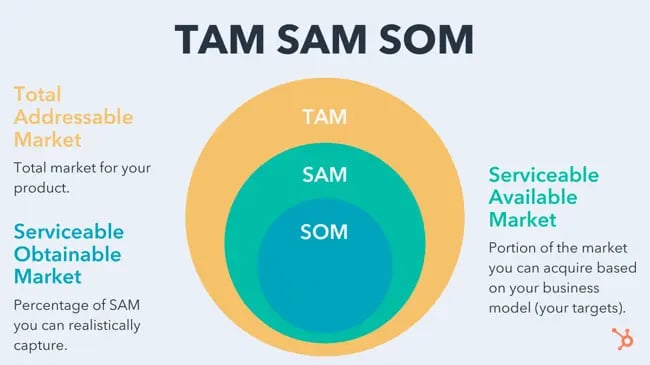

TAM

TAM stands for Total Addressable Market. This number is the maximum potential revenue or customer base that a company could achieve if it were to capture 100% of market share.

SAM

SAM stands for Serviceable Addressable Market. SAM is a part of the TAM that aligns with the company’s resources, capabilities, and target customers.

SOM

SOM stands for Serviceable Obtainable Market. SOM is the part of the SAM that a company can get at its current scale. This figure may consider marketing and sales strategies, competitive positioning, and product demand.

Check out this post to learn more about TAM, SAM, and SOM and how to calculate them.

Target Market

A target market is a specific group of customers, industries, or segments that a company focuses on. It’s the customer segment that’s most likely to show interest, purchase, and appreciate a company’s products or services.

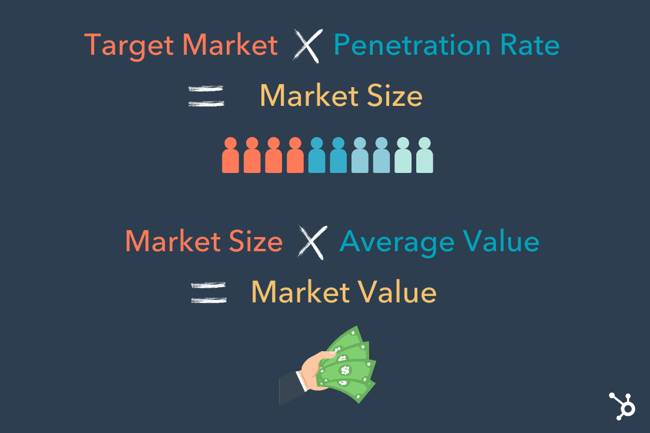

Penetration Rate

Penetration rate refers to the percentage of a target market that a company has successfully captured. It shows the level of market share reached by a company in a specific market segment or overall market.

If you’re a new business, you can calculate penetration rate by dividing your total customers by the number of potential customers in the target market. Then, multiply the result by 100 to get the percentage.

Learn more about market penetration here.

Market Segmentation

Market segmentation is the process of dividing the total market into distinct groups or segments. Usually, the people in these segments have common characteristics, needs, or behaviors.

Segmenting the market can help you better understand your target customers. It can also help you tailor business strategies, like marketing, to meet specific segment needs.

Value Proposition

A value proposition is the unique benefits that a company offers to its target customers. It differentiates a company’s product or service from competitors and creates value for customers.

Understanding the value proposition is crucial in market sizing. This is because it can help you find the specific customer segments that will find the most value in your offer.

Try one of these free value proposition templates to draft your value proposition.

How to Calculate Market Size

- Start with your total addressable market.

- Find a group of customers to focus on within that target market.

- Figure out how many of those customers are likely to buy your product.

- Multiply that customer number by estimated penetration rate.

While calculating market size takes only a few steps, it’s a crucial process. The steps below will help you understand the potential demand and revenue opportunities for your business.

1. Start with your total addressable market.

You can calculate your TAM by multiplying the total customers in a market by the annual value per customer. But before calculating, make sure you take a look at the tips below:

- Define your product or service. While developing a product can be quick, growing a business around a product is more complex. It’s important to clearly understand your product or service and how it solves a problem or meets a need in the market.

- Find your market category. Some products fall within more than one industry or market category. This is the first step that will narrow your TAM. So, think carefully about what you expect customers to compare your offer to.

- Conduct market research. Gather relevant data and information about your potential users. If you’re new to market research, check out this free market research kit, with research and planning templates.

- Analyze the competition. Conduct competitive analysis to figure out the market share and unique value of your top competitors.

- Define your total addressable market. With the research and analysis you’ve pulled together, create a realistic TAM estimate.

2. Find a group of customers to focus on within that target market.

Dig into the tips below to quantify the top customers in your market:

- Create your ideal buyer persona. Use the Make My Persona tool to outline the characteristics, demographics, and behaviors of your ideal customers.

- Segment your target market. Start dividing your target market into distinct segments. You might base segments on factors like age, location, interests, or buying behavior.

- Continue market research. Continue collecting data and insights about each segment. This will help you understand how big each segment is, as well as their needs, preferences, pain points, and purchasing habits. Your ongoing market research might include surveys, interviews, focus groups, or analyzing existing market research.

- Set pricing for your product or service. For some products, pricing is a deciding purchase factor. So, if you haven’t already, set pricing or a price range for your products.

- Assess segments of your market and prioritize. Think about each segment’s size, growth potential, and competition. It’s also a good idea to think about how each segment aligns with your company’s capabilities and resources. In short, don’t just focus on segments that offer the most attractive opportunities. Make sure they align with your strengths and needs.

- Refine your buyer personas. With your prioritized segments, take another look at your ideal customer profile. This will give you a more useful buyer persona for your marketing and sales strategies.

- Confirm your SAM with market testing. Test your target segments with a product or service pilot group, measuring their responses and feedback.

3. Figure out how many of those customers are likely to buy your product.

This step will narrow your scope more intensely on the customers who need exactly what you have to offer. These are the people who are looking for you or a clear alternative to your competitors. To quantify this group:

- Create a customer journey map. From awareness to purchase, this process can help you map out the ideal customer path. From how you expect customers to discover your products to the blockers that might keep them from clicking buy, this step is useful for market sizing and beyond. Use these customer journey templates if you’re new to this process.

- Estimate conversion rates. Use historical data, industry benchmarks, or industry research to estimate conversion rates. This can help you quantify expected numbers of leads, prospects, and customers in each segment.

- Figure out buyer intent. Create a ranking or score for each segment to measure their likelihood of purchasing your product. This can help you prioritize segments with the highest conversion potential.

- Create a SOM estimate with your data. The research above will add credibility to your market size estimate. It can also help guide your growth strategies.

4. Multiply that customer number by estimated penetration rate.

To calculate penetration rate, divide the SOM you calculated above by your TAM, then multiply by 100.

Once you have a calculation for your market size, you’ll want to make sure you can trust that number. Keep your market sizing current with these tips:

- Confirm your data is accurate and reliable. As you complete your research, use reliable sources such as industry reports, market studies, or government databases. Also, check to ensure the data you’re referencing is up to date.

- Keep up with market growth, seasonality, industry trends, tech advancements, regulatory changes, and economic conditions. These factors can affect both market size and customer demand.

- Review and update your market size estimates regularly. Market conditions change over time. Plan regular reviews of your market size, then update your calculations with new or relevant data.

Market Sizing Methods

There are two simple methods for market sizing your business. These straightforward processes can help you use data to gauge market size.

Top Down Approach

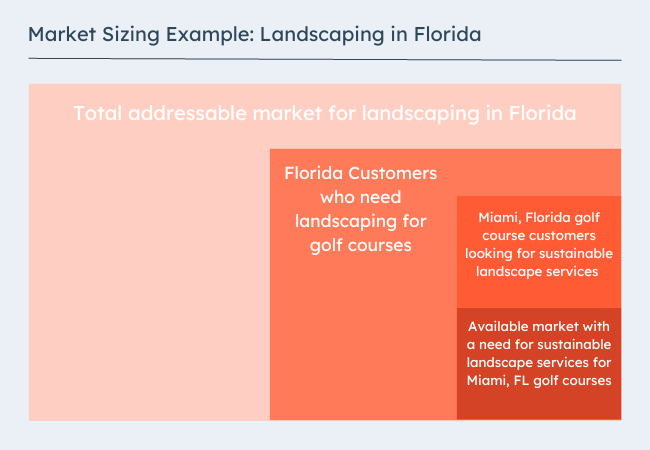

The first is a top-down approach, in which you start by looking at the market as a whole, then refine it to get an accurate market size. That would look like starting from your total addressable market and filtering from there.

Market Sizing Example

Let’s say you want to launch a wine company. First, you’d want to figure out how many liquor stores are in the United States — this helps you figure out the total market to which you could theoretically sell your product.

After your research, you discover there are 50,000 liquor stores in the United States. Of that total list, you only want to sell to the New England area — including Massachusetts, Maine, and Rhode Island.

You decide your target market includes the 1,000 liquor stores in the New England area. From here, you conduct research and speak with alcohol distributors to find there’s a roughly 40% success rate for wine distribution.

Using this as an example, we’d calculate the market size using the following formula:

1,000 liquor stores x 40% = 400 liquor stores

Then, if you assume each liquor store will result in $20,000, you can figure out potential revenue using the following formula:

400 liquor stores x $20,000 = $8,000,000

This means you stand to make $8 million if you penetrate 40% of the total market in the New England area.

Bottom-Up Approach

A bottom-up approach is the exact opposite – starting small and working your way outward.

This looks like first identifying the number of units you can expect to sell then considering how many sales you anticipate from each buyer and finally the average price per unit.

Market Sizing Example

Using the same wine example – Say you found recent data showing that the average cost of a wine bottle in New England is $10. A survey shows that the average consumer buys one bottle of wine a week, or 48 bottles a year. This means that the average consumer spends $480 per year on wine.

Next, you discover that the number of consumers (or households) you can expect to reach in the New England area is 16,000.

As a result, your market size is 480 x 16,000 = $8,000,000.

It’s important to note that both methods ignore the existence of competitors, customer churn rate, and other factors that impact sales. With this in mind, you’ll want to stay conservative when estimating how much of the market size you’ll win and use this as a starting point.

How to Leverage Your Market Size

You’ve your estimated market size — now what?

Market size helps your business answer the following questions:

- How much potential revenue can we earn from this particular market? In other words, is it even worth our time and energy?

- Is the market big enough to interest us?

- Is the market growing? Will there still be opportunities to earn revenue from this market in 3, 5, 10 years?

Market size is a critical number to know when you’re looking for funding. Investors are going to need to know how much money they have the potential to make from a given market. Additionally, it’s vital to recognize whether the potential revenue you can make outweighs your business’ costs.

Once you have market size, you’ll also want to consider how saturated the market already is with your competitors’ products.

Ultimately, you can’t capture the total addressable market (TAM) — some of those people will choose competitors’ products over yours. So you’ll need to figure out whether you have a shot at earning enough consumers out of the TAM to make this a worthwhile venture.

Editor’s Note: This post was originally published in April 2019 and has been updated for comprehensiveness. This article was written by a human, but our team uses AI in our editorial process. Check out our full disclosure to learn more about how we use AI.